Greenwood County Appraiser

Greenwood County, SC - Home Page

Storm Recovery Update: Standard landfill fees for all debris will resume on March 3, 2025. Residents repairing Hurricane Helene damage can apply for a permit fee waiver until March 7, 2025. Refunds may be available for permits paid between December 1, 2024, and February 5, 2025.

https://www.greenwoodcounty-sc.gov/If your property is new construction and built in 2025, this will be the first tax year that you will be eligible for exemptions, since properties are assessed annually on January 1. File for exemptions online at www.paslc.gov before the March 1 filing deadline. File for exemptions online at www.paslc.gov before the March 1 filing deadline. No comments yet. Start the conversation.

https://www.instagram.com/p/DTniL3kkj5W/

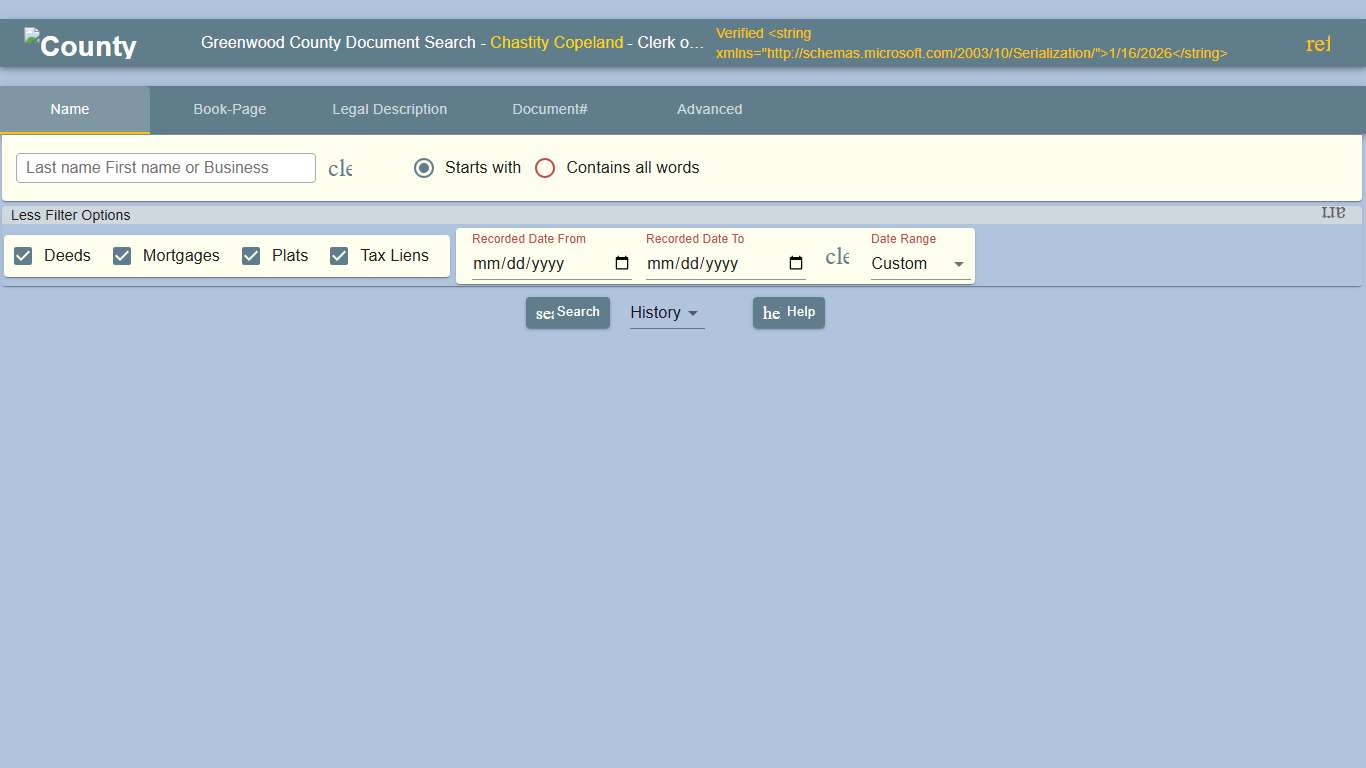

Document Search

Greenwood County Document Search, South Carolina, SC, Deeds, Mortgages, Plats...

https://www.greenwoodsc.gov/docsearchrod/

Greenwood County, Kansas

Welcome to Greenwood County! Together Growing Greenwood Greenwood County is Kansas’ 5th largest. Nestled in the beautiful rolling Flint Hills, we’re a wonderful place for families, business and agriculture. Attention! Greenwood County Voters Please be advised, if you have voted at the Matt Samuels Building, you will report to the Eureka Public Library located at 606 N.

https://www.greenwoodcounty.org/

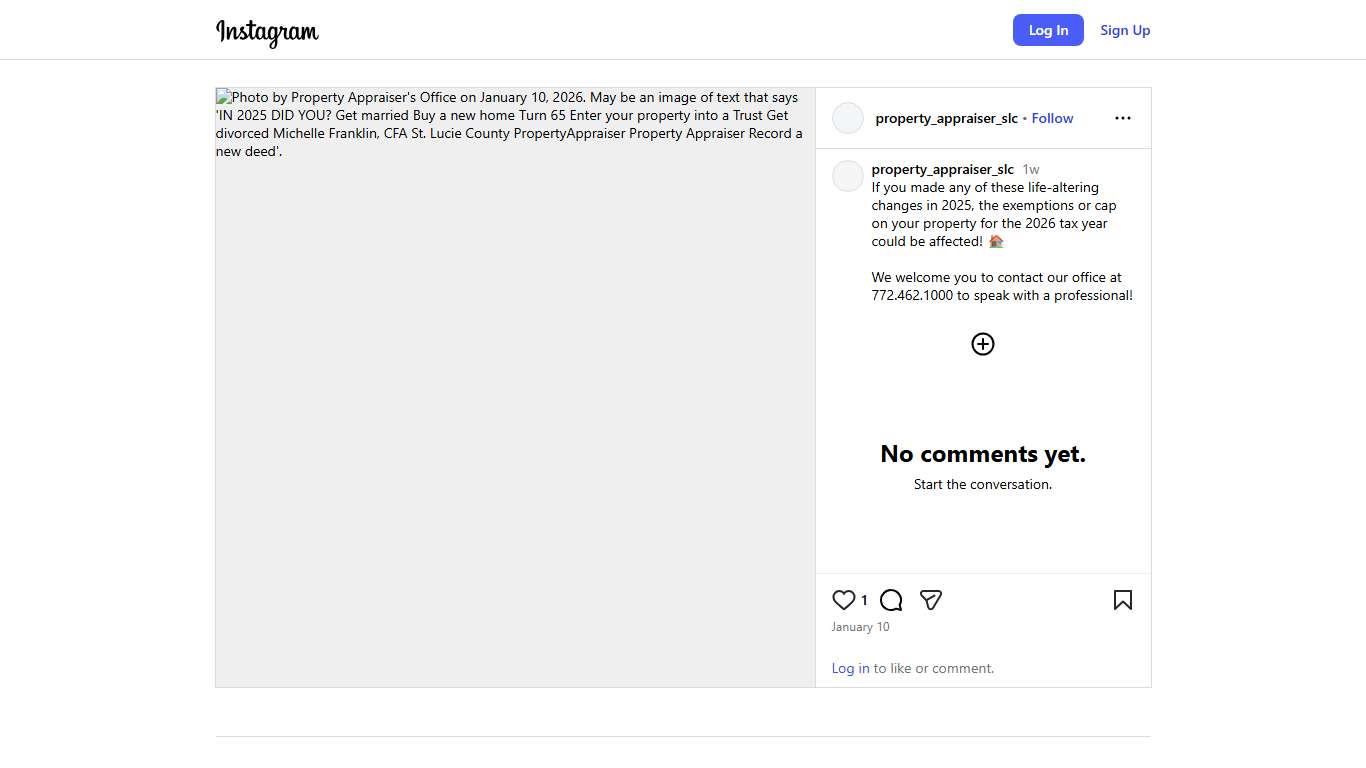

If you made any of these life-altering changes in 2025, the exemptions or cap on your property for the 2026 tax year could be affected! 🏠 We welcome you to contact our office at 772.462.1000 to speak with a professional! We welcome you to contact our office at 772.462.1000 to speak with a professional! No comments yet. Start the conversation.

https://www.instagram.com/p/DTVgpsSkpdo/

2026 Personal Property Appraisal Guide

2026 Personal Property Valuation Guide. Revised 12/2025. Page vii ... Greenwood. 0.149779. 401. 801. Sheridan. 0.119545. 502. 1,004. Hamilton.

https://www.ksrevenue.gov/pdf/ppvg.pdfReal Estate Appraisal - home appraisal - appraiser - real estate appraiser - residential appraisals - Greenwood, SC - Brown Appraisal Associates

Need An Appraisal? We’re the leaders in County appraisals. Contact Us...

https://www.brownappraisalsc.com/

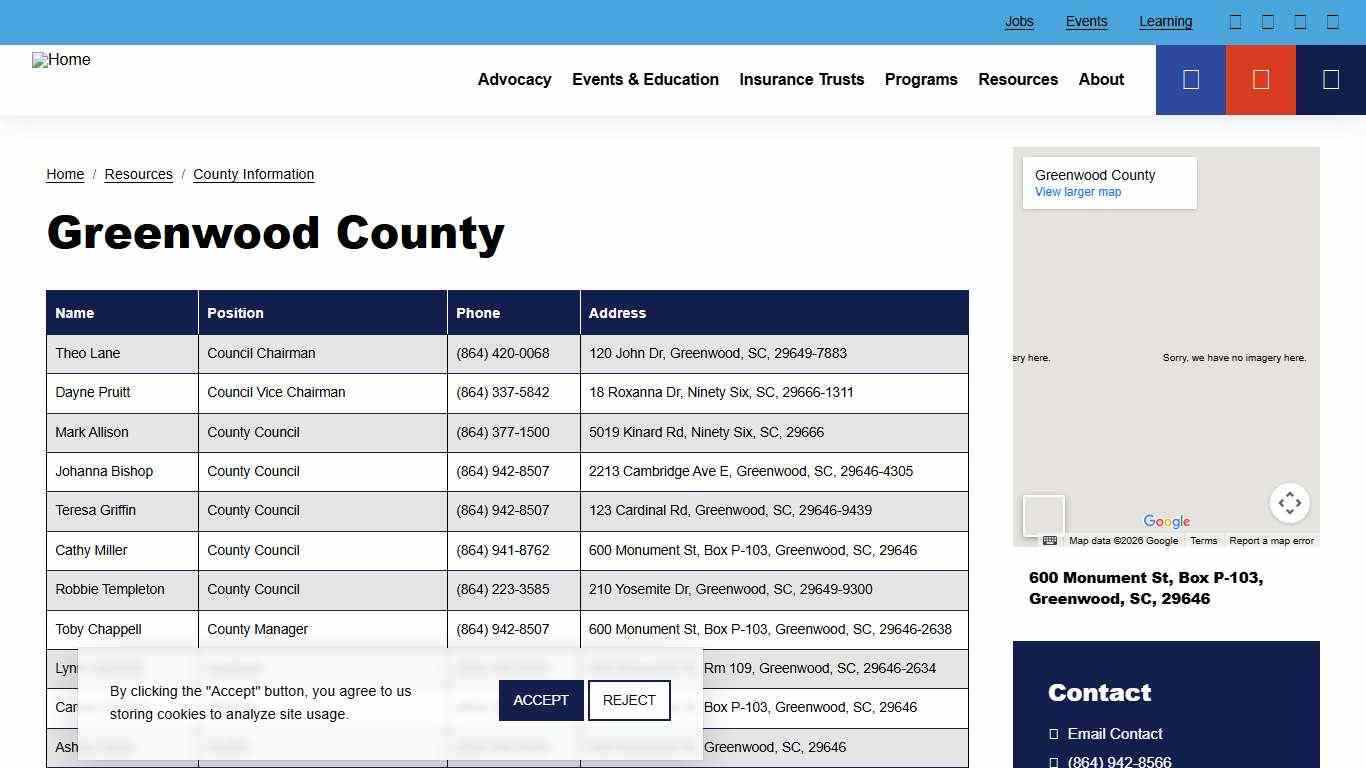

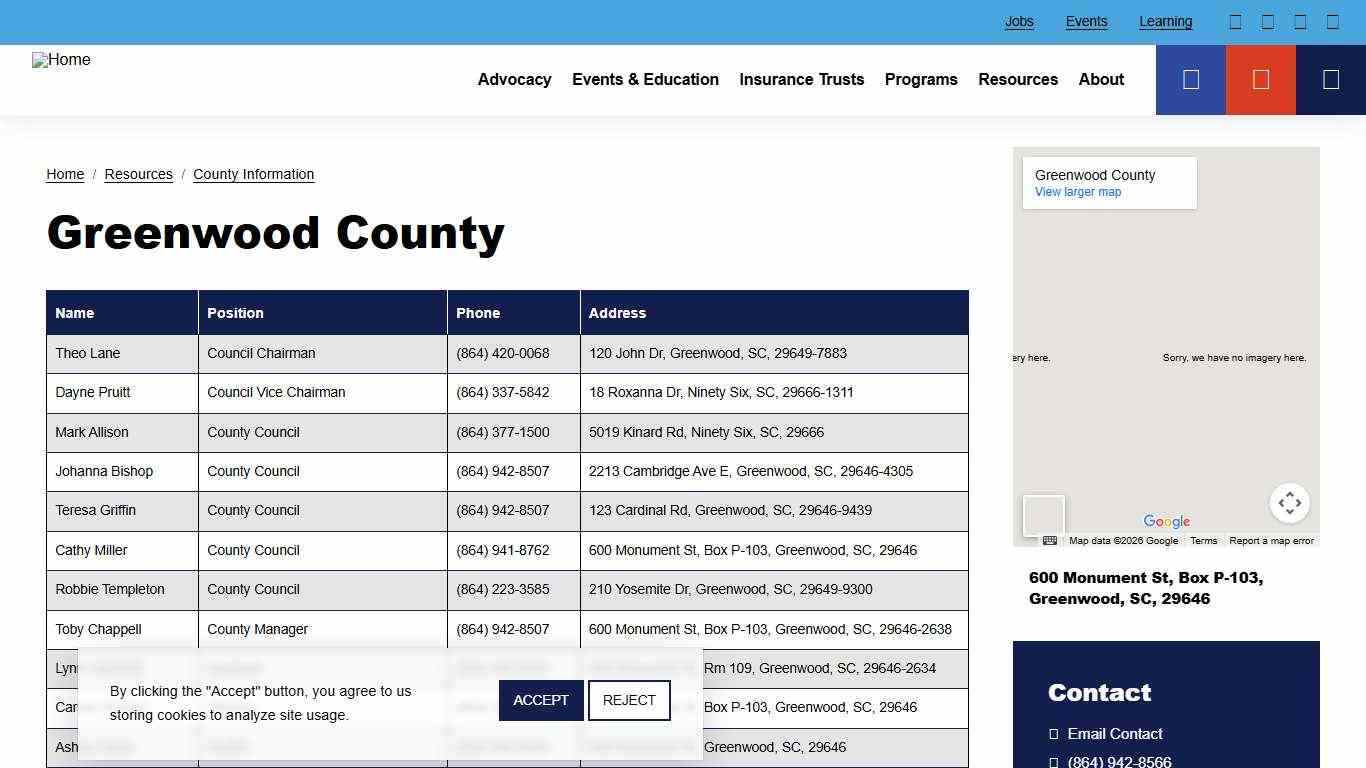

Greenwood County | South Carolina Association of Counties

By clicking the "Accept" button, you agree to us storing cookies to analyze site usage.

https://www.sccounties.org/county/greenwood-county/directory

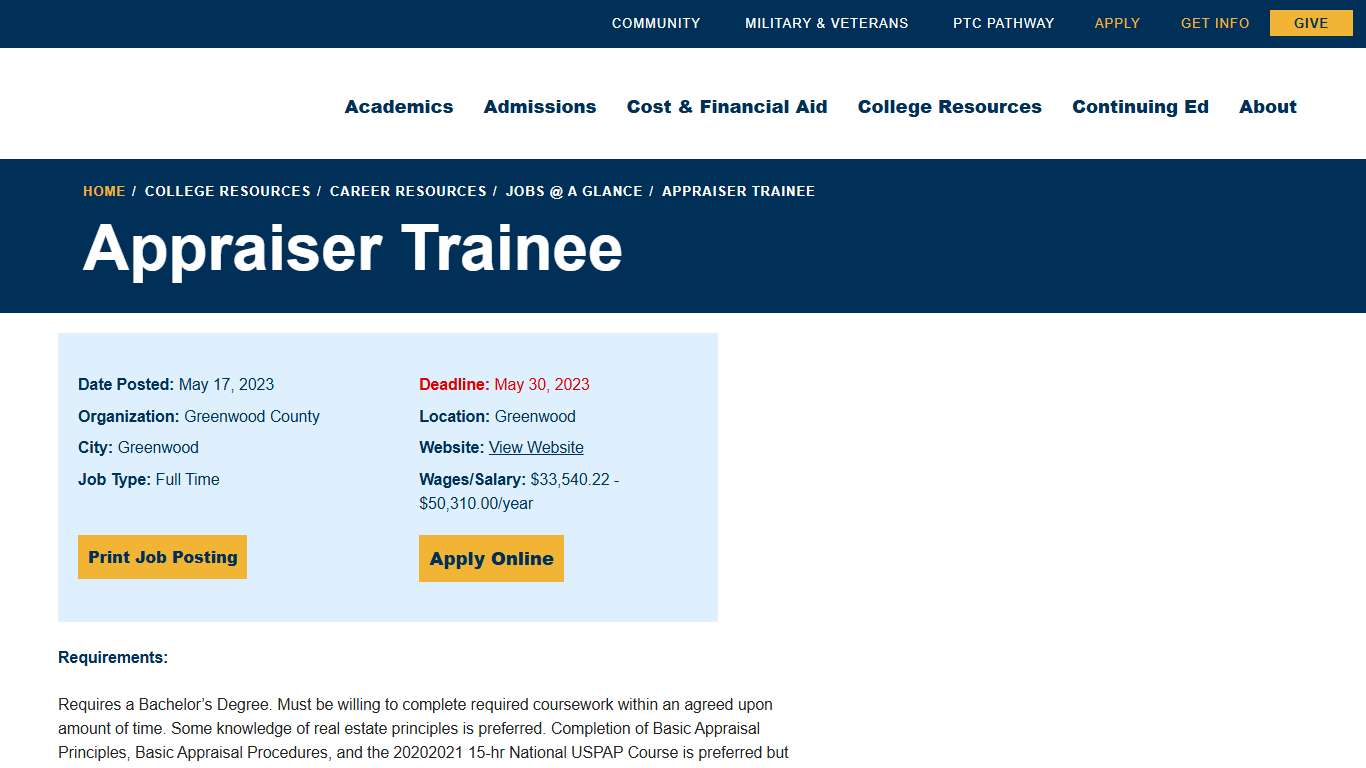

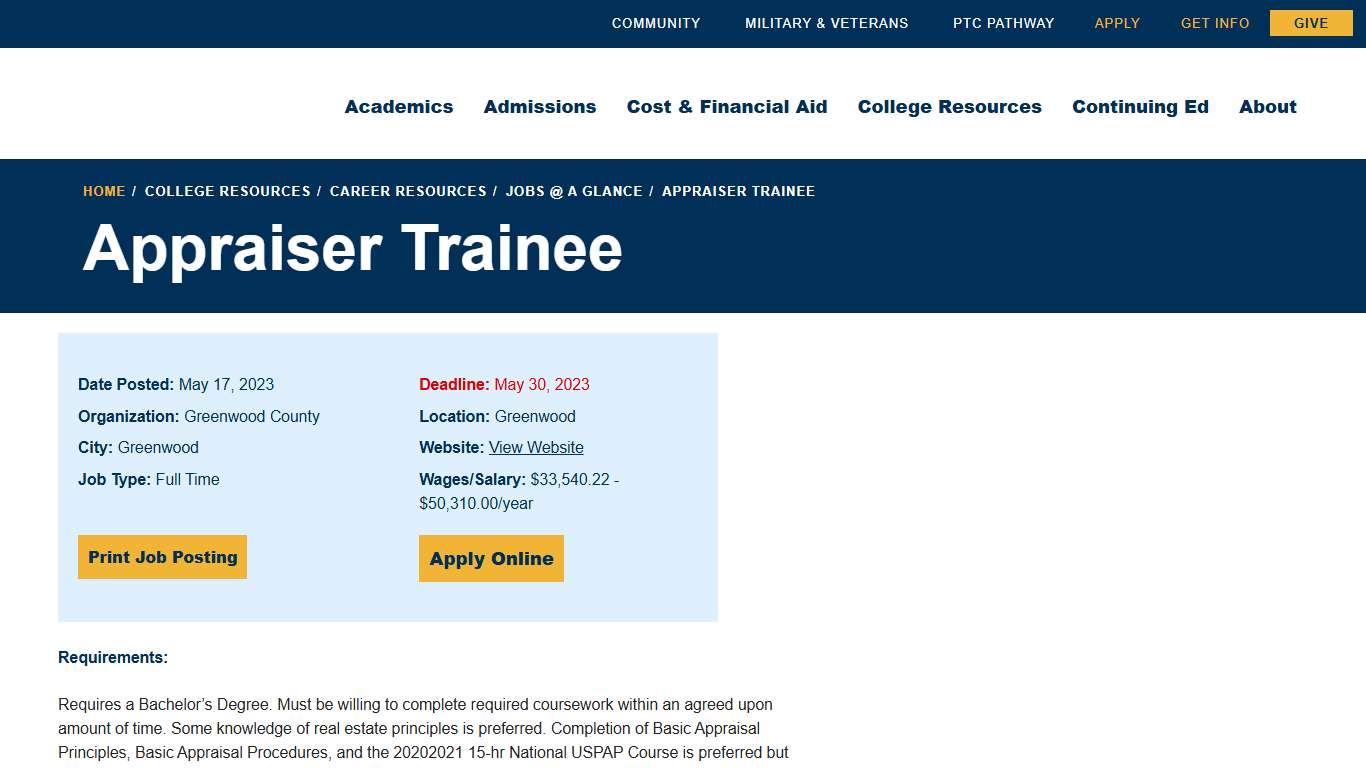

Appraiser Trainee 13601 | Piedmont Technical College

Date Posted: May 17, 2023 Deadline: May 30, 2023 Organization: Greenwood County Location: Greenwood City: Greenwood Website: View Website Job Type: Full Time Wages/Salary: $33,540.22 - $50,310.00/year Requires a Bachelor’s Degree. Must be willing to complete required coursework within an agreed upon amount of time.

https://www.ptc.edu/jobs-a-glance/appraiser-trainee-1

Greenwood County, SC Property Tax Calculator 2025-2026

Calculate Your Greenwood County Property Taxes Greenwood County Tax Information How are Property Taxes Calculated in Greenwood County? Property taxes in Greenwood County, South Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.66% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/southcarolina/greenwood-county

Appraiser Trainee 13601 | Piedmont Technical College

Date Posted: May 17, 2023 Deadline: May 30, 2023 Organization: Greenwood County Location: Greenwood City: Greenwood Website: View Website Job Type: Full Time Wages/Salary: $33,540.22 - $50,310.00/year Requires a Bachelor’s Degree. Must be willing to complete required coursework within an agreed upon amount of time.

https://www.ptc.edu/jobs-a-glance/appraiser-trainee-1

Greenwood County | South Carolina Association of Counties

By clicking the "Accept" button, you agree to us storing cookies to analyze site usage.

https://www.sccounties.org/county/greenwood-county/directory

Property Tax Payments | South Carolina

Counties with Online Property Tax Payments...

https://sc.gov/property-tax-payments

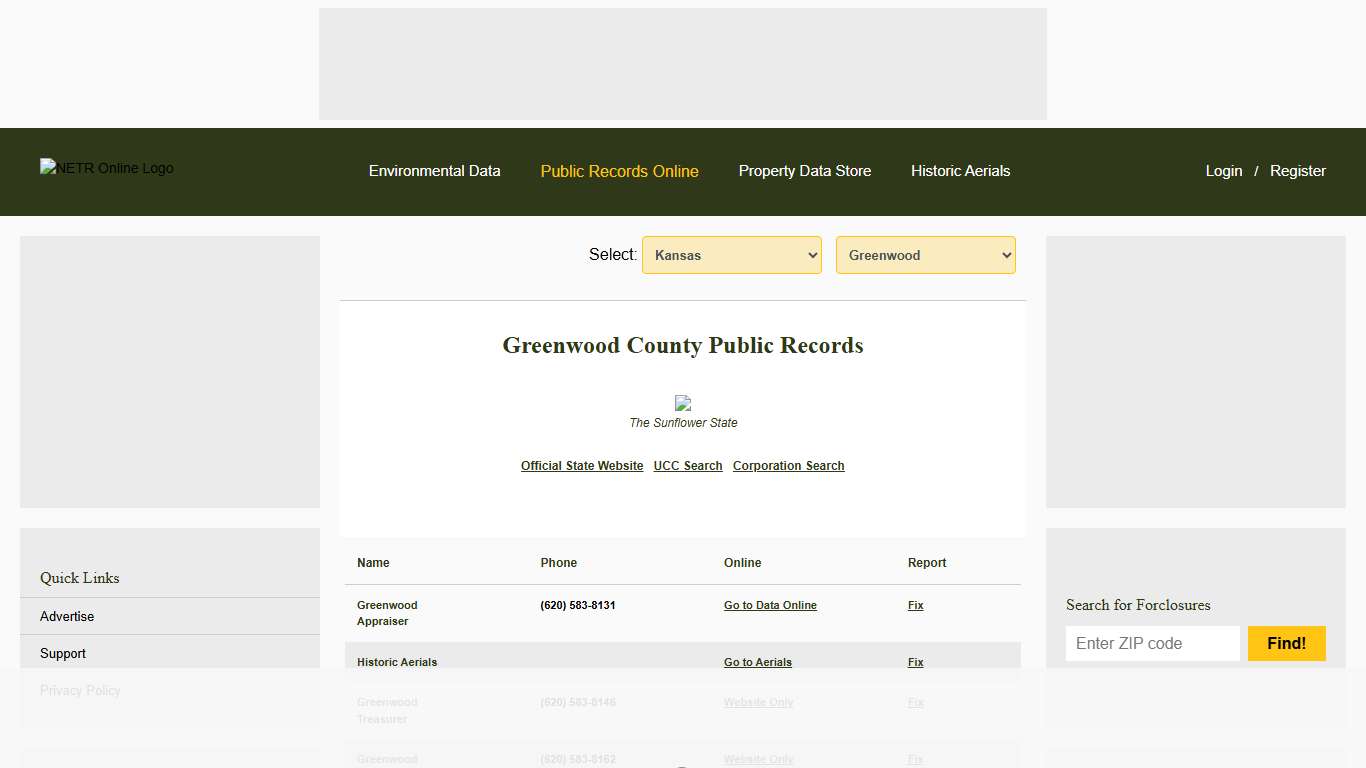

NETR Online • Greenwood • Greenwood Public Records, Search Greenwood Records, Greenwood Property Tax, Kansas Property Search, Kansas Assessor

Select: Greenwood County Public Records The Sunflower State Greenwood Appraiser (620) 583-8131 Greenwood Treasurer (620) 583-8146 Greenwood Register of Deeds (620) 583-8162 Greenwood NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/KS/county/greenwood

Assessor / Johnson County, Indiana

The official website of Johnson County, Indiana...

https://johnsoncounty.in.gov/department/index.php?structureid=14

Jami Clark, Appraiser, Greenwood County - League of Kansas Municipalities

- About - Resources - Learning & Events - Advocacy - News & Publications - Jobs...

https://www.lkm.org/members/?id=41499740

Tax Statements Mailed Out Last Week

According to the Greenwood County Treasurer, 2025 Property Tax Statements were mailed out late last week. The graphs published with this article are to assist taxpayers by showing what percentage of their tax dollar goes to the various agencies of government.

https://www.eurekaherald.com/article/5029,tax-statements-mailed-out-last-week

If your property is new construction and built in 2025, this will be the first tax year that you will be eligible for exemptions, since properties are assessed annually on January 1. File for exemptions online at www.paslc.gov before the March 1 filing deadline. File for exemptions online at www.paslc.gov before the March 1 filing deadline. No comments yet. Start the conversation.

https://www.instagram.com/p/DTf6rCCkuaW/